일부 지역 또는 통화의 경우, 은행 송금(전신 송금)을 이용할 수 없다는 점에 유의하시기 바랍니다.

은행 계좌는 어떻게 설정하나요?

은행 계좌를 설정하려면 먼저 ‘숙소 설정’에서 요금 수령 방법이 은행 송금으로 설정되어 있는지 확인해야 합니다. 다른 요금 수령 방법으로 설정되어 있는 경우, 아래 페이지가 YCS에서 표시되지 않을 수 있습니다. 요금 수령 방법 변경에 관한 자세한 내용은 다음 글을 참조해 주시기 바랍니다. 다른 요금 청구 방법으로는 무엇이 있으며 결제 원리는 어떻게 되나요?

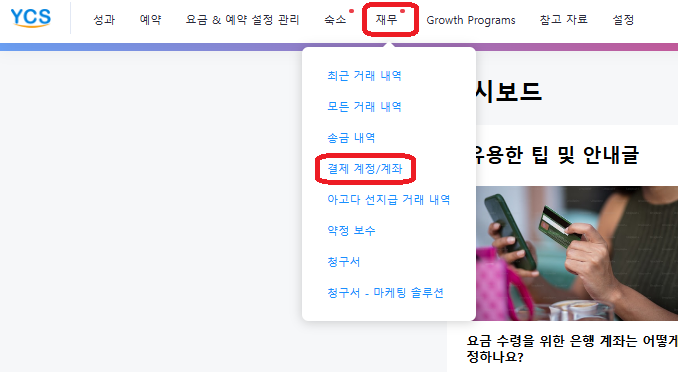

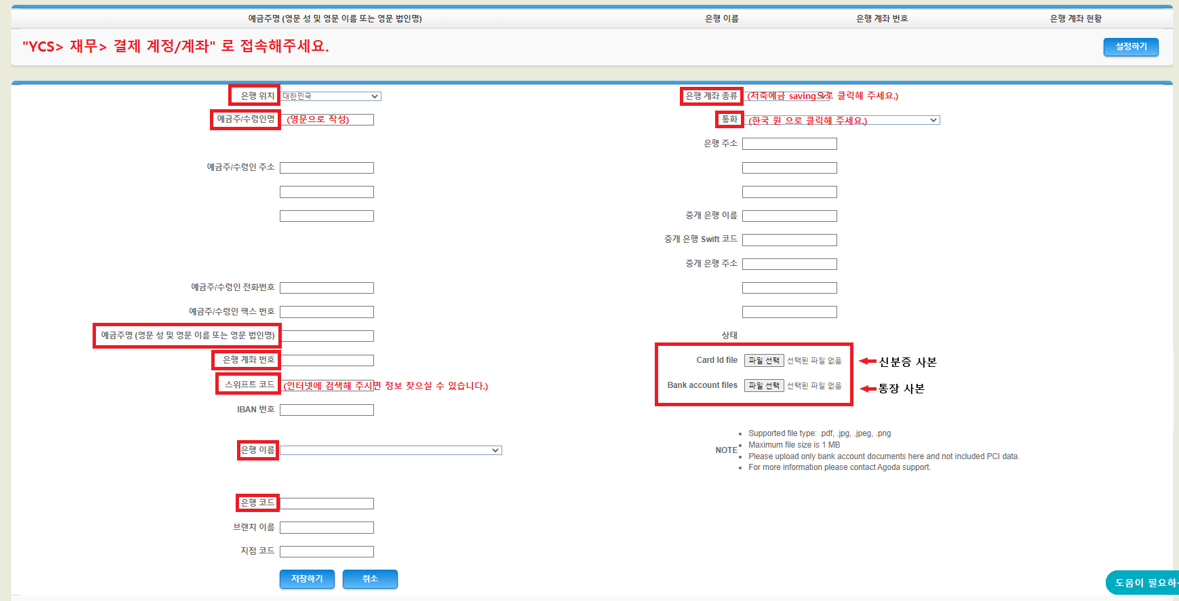

- YCS >> ‘재무’ >> ‘결제 계정/계좌’

페이지로 이동하세요.

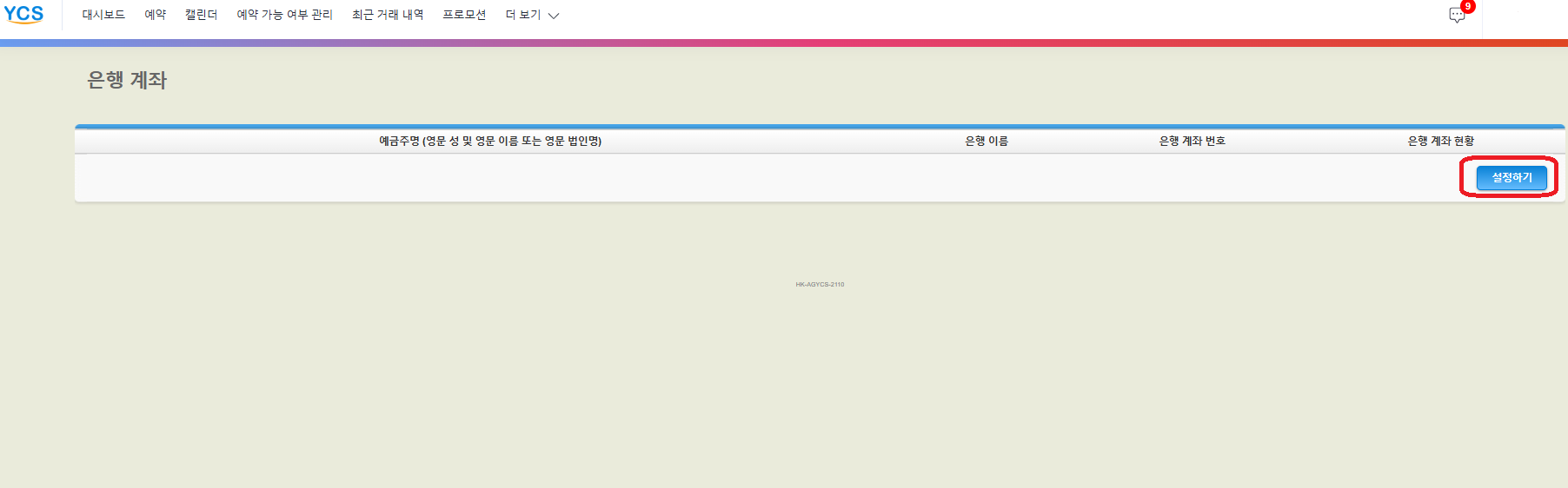

페이지로 이동하세요. - ‘설정하기’를 클릭해 은행 계좌 양식을 여세요.

- 영어로 양식을 작성하고 ‘저장하기’를 클릭하세요. 입력한 계좌 정보는 은행 계좌 요건과 국가별 필수 요건을 준수해야 합니다. 이에 대한 자세한 내용은 다음 섹션에 기재되어 있습니다.

- ‘파일 선택’을 클릭해 아래의 모든 필요 서류를 업로드하세요.

- 은행 계좌 이름 및 은행 계좌 번호가 명확히 기재된 은행 계좌 소유권 증빙 서류 (통장 사본, 온라인 명세서, 은행 입출금 명세서 및 취소된 수표)

- 계좌 소유주의 이름과 일치하는 정부 발급 신분증 (개인 계좌인 경우에만 해당 )

- 유효한 증빙 서류에 대한 자세한 내용은 이 파일을 참조해 주시기 바랍니다.

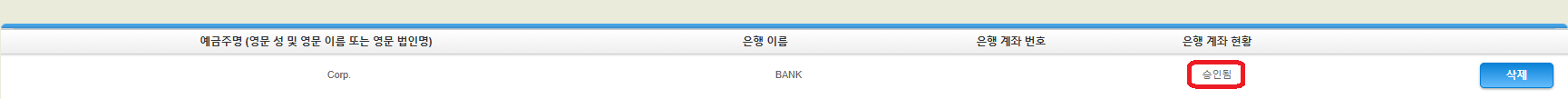

- 양식 제출 후에는 당사의 승인 전까지 상태가 ‘승인 대기 중’으로 표시되며, 승인 여부는 영업일 기준 5일 이내에 이메일로 알려드립니다. 모든 검토를 적절한 절차에 따라 진행하기 때문에 검토 절차에 다소 시간이 소요될 수 있다는 점 양해 부탁드립니다.

- 영업일 기준 5일 후에도 상태가 변경되지 않는 경우 추가 지원을 위해 아고다로 연락해 주시기 바랍니다. YCS에서 페이지 오른쪽 하단에 있는 ‘도움이 필요하신가요?’ 버튼을 클릭해 당사와 연락을 취할 수 있습니다.

- 영업일 기준 5일 후에도 상태가 변경되지 않는 경우 추가 지원을 위해 아고다로 연락해 주시기 바랍니다. YCS에서 페이지 오른쪽 하단에 있는 ‘도움이 필요하신가요?’ 버튼을 클릭해 당사와 연락을 취할 수 있습니다.

- 승인 후, 숙소는 은행 송금 방식을 통해 요금을 수령할 수 있습니다.

- 이에 대한 자세한 내용은 다음 글을 참조해 주시기 바랍니다. 은행 송금을 통한 예약 요금 청구는 어떻게 하나요?

- 이후 은행 계좌 정보를 변경할 경우, 상태가 다시 ‘승인 대기 중’으로 변경될 수 있으며 승인을 받으려면 영업일 기준 5일이 추가로 소요된다는 점 유의하시기 바랍니다.

은행 계좌 요건

은행 계좌 설정 시 다음 은행 계좌 요건에 유의하시기 바랍니다.

- 필요 서류:

- 통장, 온라인 명세서, 은행 명세서 등 은행 계좌 소유를 증명할 수 있는 서류를 구비해야 합니다. ATM 영수증 및 송금 내역은 증빙 서류로 인정되지 않습니다. 개인 계좌의 경우, 계좌 소유주의 이름과 일치하는 정부 발급 신분증이 필요합니다. 유효한 증빙 서류에 대한 자세한 내용은 이 파일을 참조해 주시기 바랍니다.

- 계좌 소유주의 이름, 계좌명, 은행명이 모든 증빙 서류에 명확하게 표기되어야 합니다. 법인 계좌의 경우, 계정 소유주의 이름이 법인명 하에 표기되어야 합니다.

- 증빙 서류는 현지 언어로 제출해야 합니다. 영어로 된 은행 명세서도 제출 가능합니다.

- [알림] 신용카드 정보와 비밀번호와 같은 민감한 정보는 신중히 관리해야 합니다. 이메일 또는 안전하지 않는 채널을 통해 해당 정보를 공유하지 마시기 바랍니다.

- 문자 제한:

- 영문 알파벳 및 숫자(0~9)만 사용할 수 있습니다.

- 특수 문자(예: = ! “ $ % & : * < > ; , # { } [ ] \ _ ^ | ~ @)는 [ ] 허용되지 않습니다.

- 은행 계좌 정보에 ‘&’ 표시가 포함되어 있는 경우 ‘and’로 바꿔주시기 바랍니다. (중국 및 일본의 경우, 예외가 적용될 수 있습니다.)

- 예금주명:

- YCS 상의 예금주명은 증빙 서류 상의 예금주명과 일치해야 합니다.

- YCS 은행 계좌 양식:

| 필드명 | 내용 |

| 은행 위치 | 은행 소재 국가 다음 국가/지역에 소재한 숙소의 경우, 관련 은행 계좌도 해당 국가/지역 내에 소재해야 합니다.

|

| 수취인 이름(현지어) | 증빙 서류에 현지 언어로 기재된 이름 |

| 예금주/수령인 이름 | 증빙 서류에 기재된 예금주명 |

| 예금주/수령인 주소 | 증빙 서류에 기재된 예금주의 주소 |

| 예금주명 | 증빙 서류에 기재된 예금주명 |

| 계좌 번호 | 증빙 서류에 기재된 계좌 소유주와 관련된 번호 |

| SWIFT 코드 | 전 세계 은행을 식별하기 위해 사용되는 8~11자로 구성된 코드 (예: ASCBVNVX) *SWIFT 코드는 은행으로 문의하시기 바랍니다. |

| IBAN 번호 | 국제적으로 은행 계좌를 식별하는 코드, IBAN은 국가 코드 + 숫자로 구성되어 있습니다. (예: GB12345678912345678912) *IBAN 코드는 은행으로 문의하시기 바랍니다. |

| 은행명 | 수취 은행의 이름 |

| 은행명(현지어) | 현지 언어/문자로 기재된 수취 은행 및 지점 이름 |

| 은행 코드 | 특정 은행의 고유 식별 코드 |

| 지점 코드 | 특정 은행 지점의 고유 식별 코드 |

| 은행 계좌 유형 | 은행 계좌의 유형 계좌 유형은 은행 통장에서 확인할 수 있습니다. 또는 은행에 직접 문의하시기 바랍니다. |

| 통화 | 해당 계좌의 수취 가능 통화 |

| 은행 주소(영문) | 은행의 실제 주소 |

| 상태 | 승인됨(Approved) – 은행 계좌가 승인된 상태 |

| 승인 거부(Rejected) – 은행 계좌가 승인 거부된 상태 (추가 정보가 포함된 이메일이 전송됩니다) | |

| 승인 대기 중(Pending) – 아고다에서 은행 계좌 정보를 수신하였으며 재무팀의 검토를 대기 중인 상태 |

- 국가별 필수 요건

| 국가명 | 필드명 | 필수 요건 |

| 호주 | 지점 코드 | 6자리 숫자 123456 |

| 계좌 번호 | BSB 코드 제외해야 함 | |

| 중국 | 은행명(현지어) | 은행명 및 지점명을 중국어로 기재 |

| 수취인 이름(현지어) | 수령인 이름을 중국어로 기재 | |

| 예금주/수령인 주소 | 반드시 2줄로 입력 첫 번째 줄: 건물번호, 도로명, 지구(30~35자리) 두 번째 줄: 도시, 도, 국가(30~35자리) | |

| 인도 | IFSC | 11자리 숫자 형식, 문자는 대문자만 사용 가능 (예: HDFC1234567) |

| 인도네시아 | 예금주명 | 반드시 은행에 등록된 이름과 일치해야 함 |

| 일본 | 계좌 번호 | 7자리 숫자 (예: 0012345) |

| 은행 코드 | 4자리 숫자 (예: 1234) | |

| 수취인 이름(현지어) | 1. 대문자만 사용 가능 2. 반드시 은행에 등록된 반각 가타카나 이름과 일치해야 함 (영어로 등록된 경우 대문자로만 입력) 3. 영문 키보드의 하이픈 (-) 사용 4. 법적 약어 사용 (예: カ) | |

| 은행 계좌 유형 | ‘예금 계좌’ 및 ‘당좌 계좌’ 만 가능 (반드시 통장과 일치해야 함) | |

| 필리핀 | 예금주/수령인 주소 | 반드시 세 줄로 입력 첫 번째 줄: 방 번호/사무실 이름, 건물 이름/주택 번호, 거리, 구/동/바랑가이(Barangay) 두 번째 줄: 지구, 도시, 도시 이름 세 번째 줄: 주(Province), 우편번호 |

| 러시아 | 은행 코드 | RU+ 은행의 BIK 코드 (예: RU123456789) |

| 예금주/수령인 주소 | 세 번째 줄: 법인인 경우 숙소의 KPP 코드 입력 KPP123456789 개인에 대한 호텔 INN 코드 입력. (예: INN123456789012) | |

| 싱가포르 | SWIFT 코드 | 반드시 11자리 형식으로 입력 (예: DBSSSGSGXXX) |

| 태국 | 은행 코드 | 7자리 숫자 (선택한 은행명에 따라 은행 코드가 자동으로 팝업 됨) |

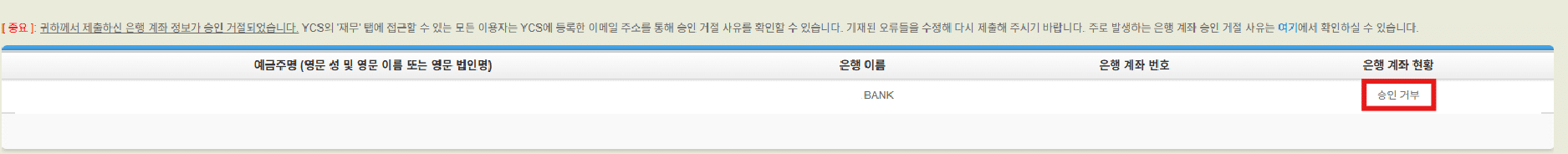

은행 계좌가 승인 거부된 경우 어떻게 해야 하나요?

은행 계좌 양식과 증빙 서류 제출 후에는 재무팀에서 승인 여부를 검토합니다. 승인이 거부되는 경우, 이메일을 통해 해당 건에 대한 구체적인 정보를 알려드립니다.

- 사용될 수 없는 문자가 입력된 경우 자세한 정보는 은행 계좌 요건에서 확인하시기 바랍니다.

- 증빙 서류가 누락된 경우 증빙 서류에 관한 자세한 내용은 이 파일을 확인하시기 바랍니다.

- 예금주명이 부정확한 경우 예금주명은 증빙 서류의 이름과 일치해야 합니다.

- 은행 계좌 번호 또는 IBAN이 부정확한 경우

은행 계좌 정보를 업데이트하기 전에 은행 계좌 요건을 주의 깊게 읽어보시기 바랍니다.

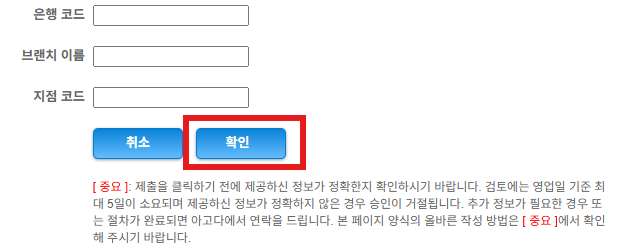

제출한 은행 계좌 정보를 수정하려면 어떻게 해야 하나요?

제출한 내용을 수정하면 검토 기간이 초기화되기 때문에 세부 정보를 모두 정확하게 입력했는지 확인해 주시기 바랍니다. 반드시 내용 수정이 필요한 경우, 다음 단계에 따라 수정해 주시기 바랍니다.

- YCS >> ‘재무’ >> ‘결제 계정/계좌’ 페이지로 이동해 제출한 은행 계좌를 클릭하세요.

- 정보를 수정하거나 필요한 경우, 증빙 서류를 다시 업로드하세요. 필요한 사항을 모두 수정한 후, ‘제출하기’를 클릭하세요.

- 변경된 내용은 재무팀이 다시 검토하게 됩니다. 그리고 승인 여부를 이메일로 알려드립니다.

아고다로 연락하기

도움이 필요하신 경우, YCS로 이동해 페이지 오른쪽 하단에 있는 ‘도움이 필요하신가요?’ ![]() 버튼을 클릭하세요. YCS 접근 권한이 없는 경우, 기타 방법을 통해 당사로 연락해 주시기 바랍니다.

버튼을 클릭하세요. YCS 접근 권한이 없는 경우, 기타 방법을 통해 당사로 연락해 주시기 바랍니다.

본 게시글이 도움이 되셨나요?

%

%

소중한 의견에 감사드립니다.